Ellason lens on… 2024/25 pay decisions (September year ends)

Fri 14, February

As we head into the 2025 AGM season, Ellason has reviewed the FY24 and FY25 pay decisions for those FTSE companies with September year ends (21 companies reporting to date) to identify any early trends.

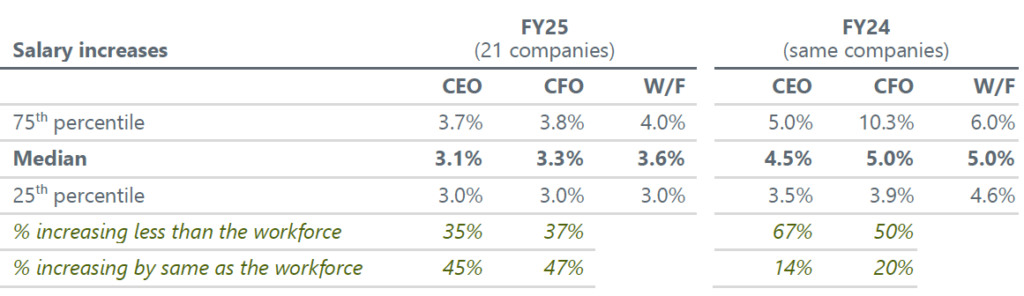

The gap between salary increases for senior executives and the workforce continues to narrow

Almost all companies in the sample have awarded salary increases to Executive Directors for FY25, with the exceptions generally being where there is a newly appointed director, or an existing director is soon to be stepping down. The strong prevalence of increases for senior executives continues a trend from FY24, but contrasts with the trend in previous years for around a quarter of companies to award no salary increase.

For Executive Directors, the median FY25 salary increase is currently tracking at 3.2%, down from 4.7% for the same companies in FY24 (and 4.0% across the full FTSE All-Share last year). The median reported workforce salary increase for FY25 is, at 3.6%, still slightly higher than that for executives but the gap has narrowed. Only around one-third of companies in the sample set the salary increase for at least one of their Executive Directors below the workforce increase, down from c.70% last year; companies are returning to the prior practice of aligning Executive Director and workforce salary increases as inflation normalises.

It remains to be seen how the changes to the Employers’ National Insurance contribution rate and earnings threshold announced in the Autumn Budget will impact salary increase figures, but we anticipate the median workforce increase will stabilise around 3.0-3.5% over the full reporting year, with the median executive salary increase not far behind.

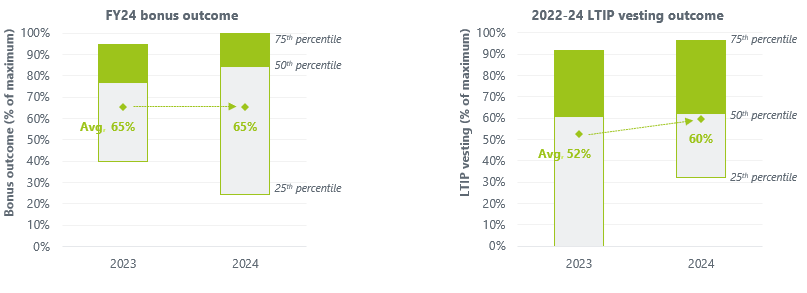

Bonus payouts are mixed

Across the sample, the median CEO bonus payout has increased from 77% to 85% of maximum, with the average payout remaining at 65% of maximum. On a company-by-company basis, there have been mixed trends year-on-year, with nine companies paying lower bonuses than last year and nine paying higher bonuses; four companies reported the same bonus payout.

There are two instances of evidence of downwards discretion being applied to annual bonuses for FY24, because of high-priority financial objectives not being achieved (FY23: one).

LTIP vesting is stronger

Of those companies reporting LTIP cycles with a performance period ending September 2024, 89% reported at least some vesting (FY23: 68%). The median vesting outcome has remained stable, whilst average vesting has improved modestly (from 52% to 60% of maximum). A recovery in vesting levels can also be seen in the year-on-year trend in LTIP outcomes; nine companies (50%) report a higher vesting outcome for FY24 than FY23, five (28%) report a lower outcome and four (22%) report the same outcome (typically zero or full vesting).

No companies in the sample reported applying downwards discretion to its LTIP outcomes (FY23: one).

Some significant changes have been proposed to Remuneration Policies

Around half of the companies in the sample are submitting their Directors’ Remuneration Policy to a binding shareholder vote at this year’s AGM. The most common change to policy being proposed is to the opportunities available under variable incentive opportunities. Five companies propose such increases, of which three are proposing to increase the short- and long-term opportunities simultaneously – something which would have attracted significant investor scrutiny only a few years ago.

The sample also includes one company proposing to soften its annual bonus deferral requirements in the event that an executive has met the in-post shareholding requirement. This follows a number of similar proposals last year and we anticipate this trend will continue over the next 12-24 months based on our discussions with clients, and noting a growing acceptance amongst the governance community following changes to the Investment Association’s Principles of Remuneration last year.

Finally, one company is proposing to replace its restricted share plan (RSP) with a performance share plan, reversing a change made in 2021. Ellason expects this to be a common theme over the next few years, with many of the companies that moved to RSPs now better able to set longer-term targets and keen to reinforce delivery of their strategies following recent uncertainty. However, whilst this may mark the end of peak standalone RSPs, we expect they will remain a part of the UK pay landscape going forward as ‘hybrid’ arrangements start to gain traction.

Ellason commentary: Early indications are that some of the trends observed during 2024 will continue in 2025, notably in relation to salary inflation and a narrowing of the gap between ED and workforce salary increases. Additionally, the improvement in incentive outcomes (especially long-term incentives) is a trend we expect to carry over to FY25.

More broadly, it will be interesting to see whether pay proposals in 2025 further reinforce the arguments of the ‘big tent’ discussion on the competitiveness of the UK markets. In 2024, we saw companies reviewing their pay philosophies and package structures to reflect their global talent markets, notably with the implementation of hybrid schemes and a softening of annual bonus deferral requirements. The question of whether these fundamental changes will be limited to cases of larger, global companies, or extend to the wider FTSE, is something that may be answered in the run-up to the next round of Policy votes.

We will be actively monitoring developments in the coming months and will provide further updates as the AGM season unfolds.